One of the biggest advantages to working as a freight agent with Tallgrass Freight Company is that you have the freedom to be your own boss.

And to help our freight agents be as successful as possible, we cultivate an entrepreneurial company culture with a focus on education and resources.

As part of our continuing education series, we recently welcomed Michelle Unruh of Tripp Tax & Financial Services, who provided helpful tips and insight to guide our freight agents through the 2018 tax reform changes.

Understanding the New 20% Deduction

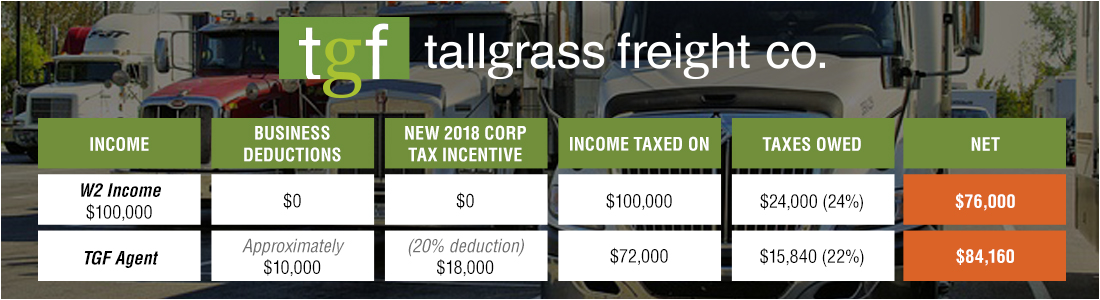

The tax reform includes a change in the tax deduction for self-employed income that reduces your taxable income on your federal tax return. Now, those in a pass-through entity—partnership, S-corporation, LLC or sole proprietor—will apply a 20 percent deduction on net business income (subject to some limits).

Let’s say you make $100,000 in revenue and you have $20,000 in expenses. That makes your net business income $80,000, to which you’d then apply the 20 percent deduction, or $16,000. As a result, your federal taxable income is $64,000. Hello, big savings!

Additionally, the standard deduction has been doubled from $6,000 to $12,000 for a single filer and from $12,000 to $24,000 for married filers. The child tax credit was also doubled and is now $2,000 for each child under 17 years of age.

General Tax Tips

In addition to walking us through tax reform changes, Michelle also shared some general tips that are helpful for anyone who’s self-employed.

- Open separate checking and savings accounts for your business

- Obtain a company credit card

- Keep track of your expenses, including receipts and invoices. A free app like MileIQ can help you track mileage.

- Work with an accountant to maximize your deductions, including health insurance, meals and entertainment, home office square footage, office supplies, technology purchases, business travel and your cell phone bill, among others.

And be sure to note the following tax-related dates on your calendar:

- Jan. 31: 1099s are due

- March 15: Deadline to file business taxes

- April 15: Deadline to file personal taxes

If you file an extension, the dates are:

- Sept. 15: Business taxes

- Oct. 15: Personal taxes

On the surface, taxes might seem more complicated for those who are self-employed, including independent freight agents. Yet, like your career, you have more control over your finances and your tax benefits as opposed to being locked in a W2 situation in which the company reaps the benefits, not you. With thorough record-keeping and guidance from a tax professional, you can establish a process that ensures you meet your obligations while maximizing your deductions and savings.

We have more continuing education topics coming up, and we’ll be sure to keep you posted on what we learn. If you’re interested in attending these sessions, reach out for more information on joining our freight agent network. We’d be thrilled to have you!